Consistency is important with QQQ investing. Like all investment options, following a set of rules can dramatically lower your risk exposure over the long term. Here are 5 simple QQQ investing strategies you can use to stay on track to reach your goals and avoid emotional trading mistakes.

1. Dollar Cost Averaging (DCA)

The goal of dollar cost averaging is to manage the cost basis of your investment through regular purchases over time. Your cost basis is the average price you paid for each share of stock. By purchasing a set amount of QQQ shares in regular intervals, your cost basis fluctuates in line with the market.

The key to dollar cost averaging is to remain committed in both bull and bear markets. It is also important to believe that the price of the QQQ ETF will go up over time. Assuming this to be true, DCA is great strategy to consistently build a compounding position over the long term.

It takes perseverance to invest using the dollar cost averaging strategy. There will stretches where the stock market goes down, or perhaps even crashes. These can be difficult times to buy into the market from a psychological perspective. However, if you pause during the downturns you will miss substantial opportunities to lower your cost basis.

2. QQQ Simple Moving Average (SMA)

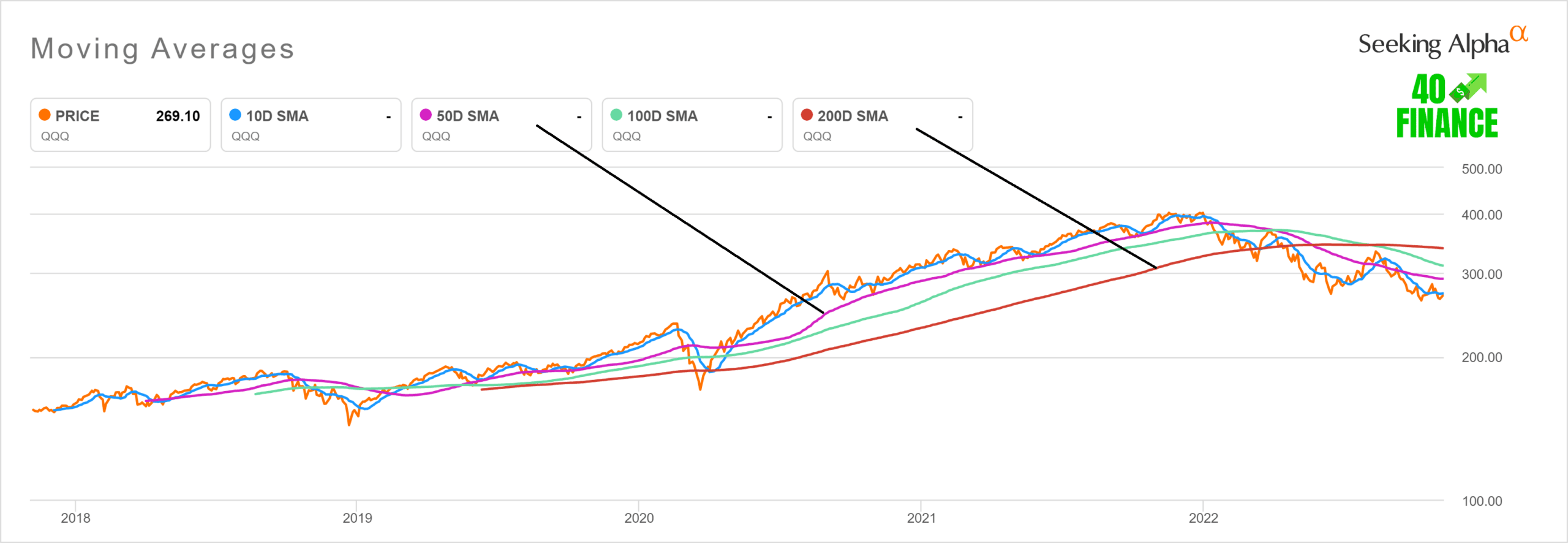

Another popular strategy for QQQ investing is to buy shares based on the 50 and 200 day simple moving averages (SMA.) These technical indicators represent the average QQQ stock price over the last 50 and 200 days.

The moving averages by themselves are not a trading strategy, but applying specific rules to how they change can be. For example, most technical analysts believe that an extended downtrend will begin when the 50 SMA crosses below the 200 SMA. Conversely, an extended uptrend is often signaled by the 50 SMA crossing above the 200 SMA. Depending on your personal investing preferences, either of these events could be a signal to buy or sell the QQQ.

3. QQQ Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a short term momentum indictor based on the changes in a stock price. The scale ranges from 0 – 100 with the average trading momentum being 50. A stock with high upward momentum can produce an RSI of 70, while a rapidly falling stock could see an RSI below 30.

The RSI levels of 70 and 30 are used as rules by some investors to buy and sell the QQQ. Those looking to buy low and sell high will wait for the QQQ to reach an RSI under 30, and then hold it until the RSI crosses above 70.

Keep in mind that RSI was designed as a short term metric. Most technical traders who use RSI focus on the 14 day setting for analysis. In the chart above, I added a line to represent where a RSI of 40 would display. As you look to the right you see that during an extended downturn like 2022, the RSI can remain low for an extended amount of time.

Buying low based on RSI can be lucrative strategy, but like the other ideas presented here, its effectiveness tends to improve the longer you hold your QQQ shares.

4. Barbell Portfolio

The barbell investing strategy is designed to balance risk by investing a similar amount of capital into two uncorrelated assets. The stock market moves in cycles between growth stocks and income/dividend stocks. By maintaining a core position in assets unrelated to the QQQ holdings, you can protect yourself against a bear market in tech stocks.

The hardest part of building a barbell portfolio with the QQQ is determining which set of assets you want on the other side of the barbell. There are many different theories investors have regarding the best hedge options. Some prefer bonds and REITS, while others opt for dividend stocks, or even cash. It is difficult to predict the perfect hedge because rarely are two stock market crashes based on the same fundamentals.

The ideal way to craft a QQQ barbell portfolio is to choose an uncorrelated asset to limit your risk to the technology stocks that comprise the Nasdaq 100. Keep in mind though that the “safe side” of your barbell doesn't have to equal 50% of your stock portfolio. You could conceivably have the majority of your stock portfolio in QQQ and balance that with businesses or real estate that is worth the same amount as your stock holdings.

5. Timing the Market

Generating returns in the stock market is based on the simple formula of buying low and selling high. One of the psychological traps that comes with this formula is the tendency to pick and choose when you will buy stocks. Behavior like this is often called timing the market, and it requires a great deal of patience to be successful.

The downside of timing the market is often accelerated losses, but there is also the reward of accelerated gains if you can correctly pick the bottom. Interestingly enough, lump sum investing has outperformed DCA in some studies. The hardest part of timing the market is avoiding the euphoria and FOMO that goes on during market highs.

No one knows when a bull market will peak, or when a bear market will reach its bottom, yet almost everyone will share their prediction to whomever will listen. Timing the market, or buying the QQQ in lump sums can certainly pay off in a big way. However, it is not a rules based investing strategy. This makes it hard to measure over time because the entry points are based on opinion.

What is the best QQQ investment strategy?

Like all investing opportunities, how you build your QQQ investment and how long you hold the shares will be the variables that determine your outcome. The good news is the performance of the QQQ over time has produced solid returns when compared to the S&P 500.

The best QQQ investing strategy is the one you can stick with for the long term. Having enough cash on hand to execute your strategy is the most important piece of the puzzle. From there you need to have patience and perseverance to follow the strategy. The bear cycles and low points will be painful, but they typically provide the best buying opportunities. If you can get past these challenges then there is a good chance the Nasdaq 100 will reward you for your investment.