Would you triple-down on the QQQ for a long term investment? One way to do this is to hold TQQQ stock, a triple leveraged ETF that seeks to replicate 3x the daily performance of the Invesco QQQ.

The ProShares TQQQ is the largest leveraged ETF, with over three times the AUM, and two times the average trading volume of its' closest competitor (SOXL) in the leveraged ETF category.

QQQ enthusiasts like myself will remind you that the NASDAQ Top 100 index has outperformed the S&P 500 for most of the past 10 years. Assuming you believe this outperformance will continue, it might seem logical to hold TQQQ for the long-term, right?

Daily Performance

The chief concern with going long on the TQQQ is the fact it replicates the DAILY performance of the QQQ. If it were designed to replicate ANNUAL performance then the decision might be easier. Let's explore how this key difference impacts results…

When it comes to leveraged ETF plays, the most common use case is for short term bullish or bearish bets on the stock market. Similar to options, these investment products offer a way to double or triple-down on an investing thesis without the need to commit the full amount of cash.

The ProShares website lists 3 common reasons for investing in the TQQQ:

- Seeking magnified gains (will also magnify losses)

- Getting a target level of exposure for less cash

- Overweighting a market segment without additional cash

Divergence

ProShares also clearly calls out the potential divergence that can occur when holding the ETF beyond a single trading day…

“Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return, and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period.”

In short, if the QQQ goes up 10% over the next 3 months it does not mean the TQQQ will go up 30% during the same period.

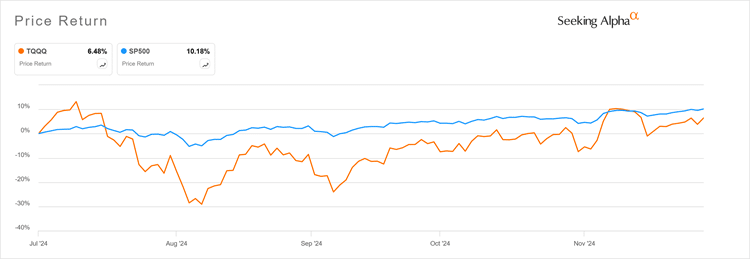

Take a look at the chart below which compares QQQ vs TQQQ over a period of 3 months from July through November in 2024.

The time frame of this chart provides an excellent comparison of QQQ vs TQQQ in terms of showing both an uptrend and downtrend. You can see how much the prices diverge during persistent upward and downward movements.

- July through August shows the results of a bearish trend. While the QQQ went down about 5% the TQQQ lost almost 30% of its value.

- In November, the QQQ saw a 5% incremental increase while the TQQQ jumped almost 20% during the same stretch.

There are 3 primary reasons the long term results of the TQQQ don't fully replicate 3x the returns of the QQQ…

1. Compounding Effects

The daily results of the QQQ have a compounding effect on the long term price of the TQQQ. This effect increases with higher volatility and longer holding periods.

For example, let's assume you invest $100 in both the QQQ and TQQQ for 3 trading days.

Let's say the price of the QQQ goes up 10% on day 1, then down 10% on day 2, then up 10% on day 3.

The QQQ would finish at $108.90 ($100 + $10 – $11 + $9.90 = $108.90)

The TQQQ would finish at $118.30 ($100 + $30 – $39 + $27.30 = $118.30)

In this example, some investors might have expected the TQQQ to finish at $130. As you can see in the example above, the compounding effect for both the gains and losses affected the final result.

2. Leverage Decay

Leverage decay is the inability of a leveraged ETF to replicate the underlying index over extended time periods. The longer you hold a leveraged ETF beyond the target timeframe, the greater the chance of the results diverging from the index.

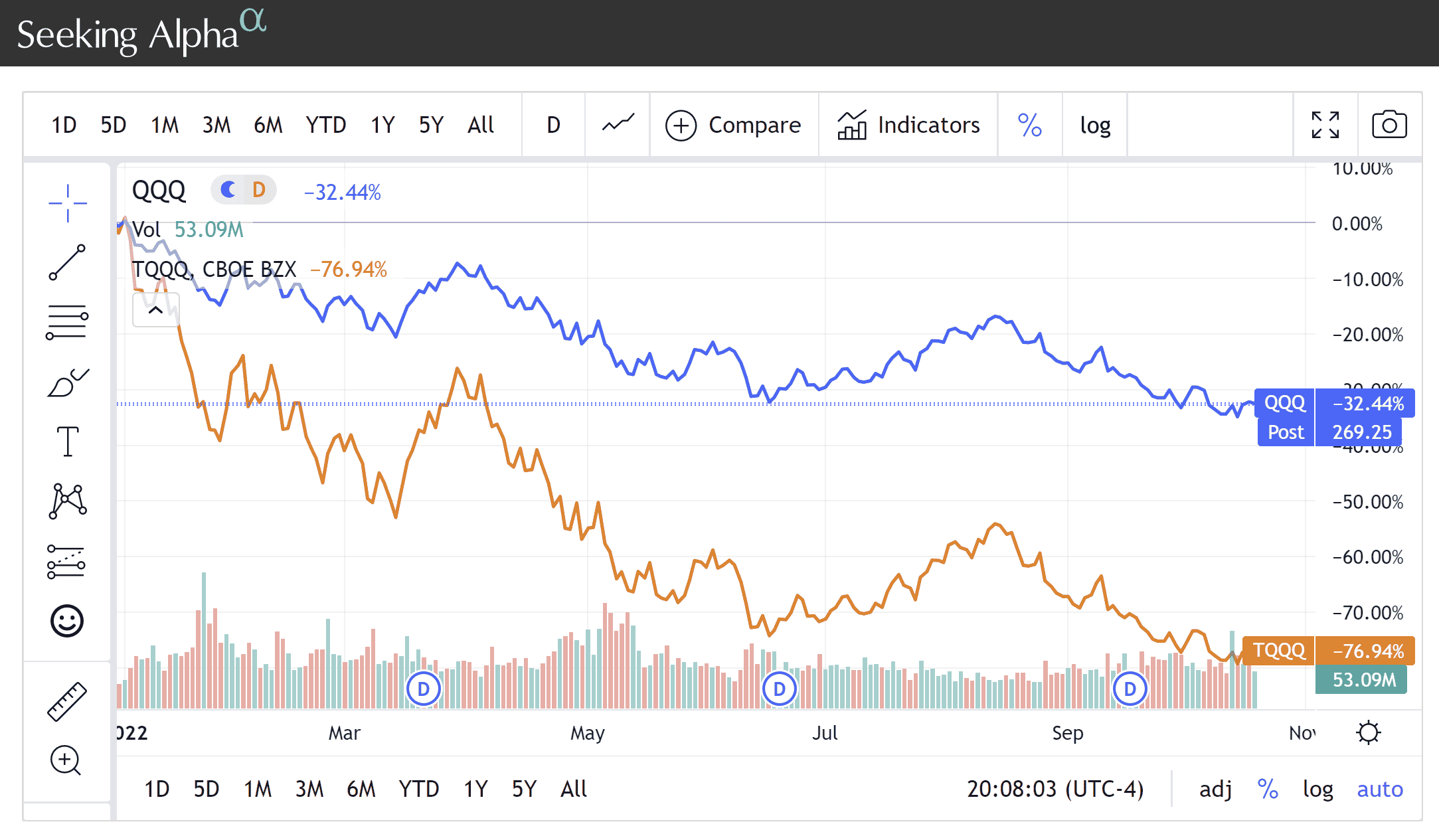

The chart below offers a comparison of the QQQ vs TQQQ in 2022. When I created this chart the QQQ was down -32.44% for the year. The expected return of the TQQQ in this scenario is -97.32% but the actual result is -76.94%. While multiple factors (compounding, decay, expenses, etc.) attributed to the end result, it is a good example of leverage decay over time.

3. TQQQ Fees

The TQQQ has an expense ratio .86% compared to .20% for the QQQ. On paper it seems like a small difference, but depending on the size of your investment it can add up. Combine the higher fee with the compounding effect and you start to see how this could chip away at returns over time.

Should you invest in TQQQ for the long term?

Now that you have a better understanding of how TQQQ performs in relation to the QQQ, you should NOT expect it to generate exactly 3x the returns of the QQQ over longer periods of time.

That being said, the QQQ has performed remarkably well since inception, despite facing challenges such as the dot-com bust, mortgage crisis, and the recent COVID boom and bust. So even with all the considerations discussed earlier, COULD the TQQQ outperform the QQQ over multiple years?

The honest answer includes your typical “yes, but” reply. The TQQQ can be a long term performer but you need a disciplined approach to managing it. Here are a few of the rules I follow…

Understand The Risks

The most obvious risk comes during a bear market. Compounding losses at three times will quickly erode profits. This reason alone is why TQQQ should never be an “all in” position. You have to recognize your own risk tolerance before investing in any leveraged ETF.

The most common concern new TQQQ investors have is the fear of it falling to zero in a 33% downturn. Technically this could happen, but the combination of leverage decay and modern stock market circuit breakers make this scenario very unlikely.

These circuit breakers stop trading on all exchanges for 15 minutes if the S&P 500 drops by 7% or 13% in a single day. If the S&P 500 drops by 20% in a single day, the market is closed until the next trading day. While the SPY is different than the QQQ, the top companies in each index are very similar.

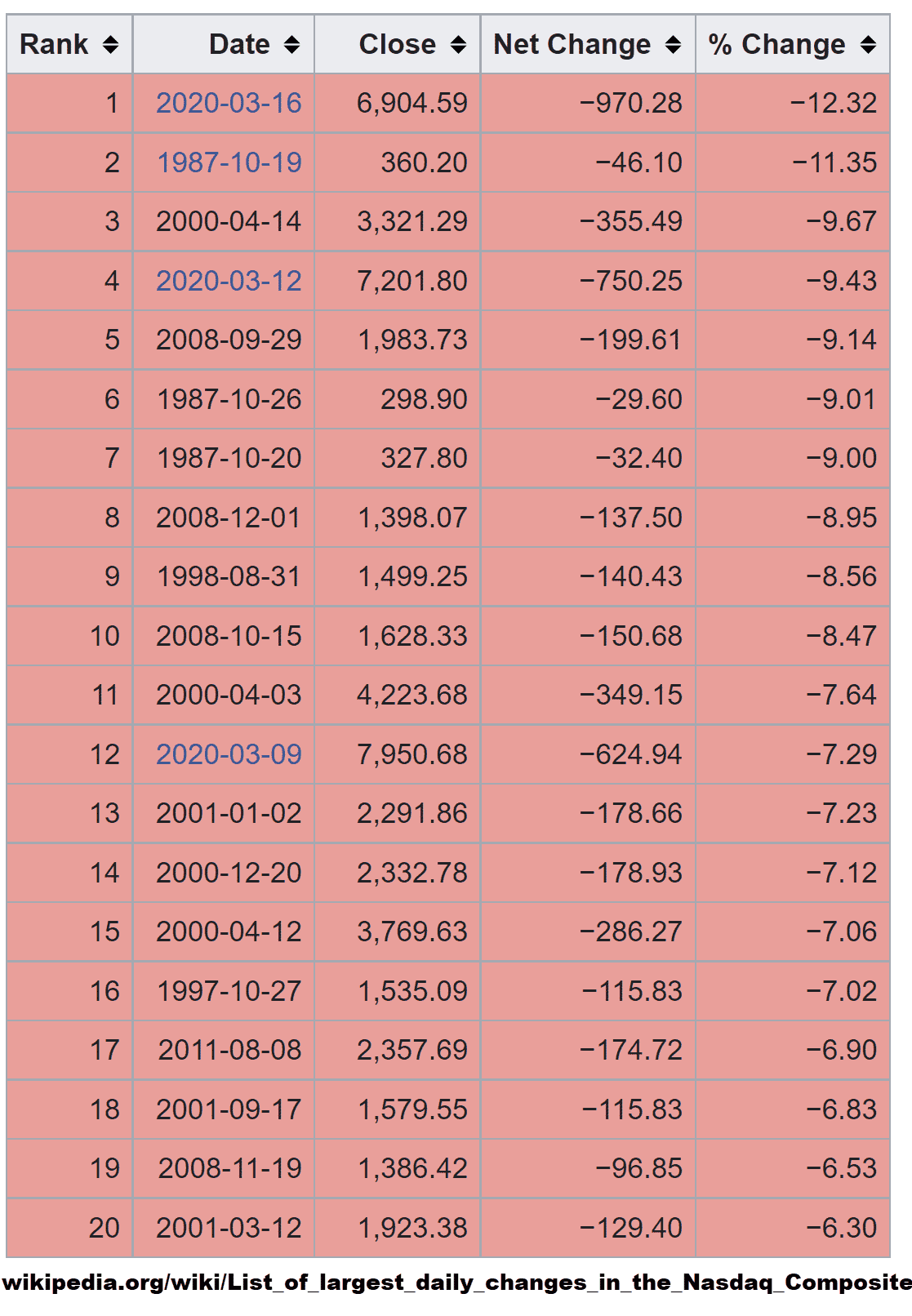

For the record, the largest single day drop in Nasdaq history was -12.3% on March 16, 2020 and there have only been two single day drops over 10%. The odds of a -33% single day drop, thus wiping the TQQQ out entirely, are incredibly low. It would take a negative macro event capable of dragging down everything tied to the stock market.

A prolonged downturn in the market is the worst scenario for the TQQQ. Consecutive months or years of downward performance would eventually whittle the price of the stock down to low levels. Keep in mind that the TQQQ resets daily, so while large chunks of value can be lopped off in the beginning of a downturn (ex. 10% of 100) the nature of percentages preserves a numerical core value for infinity.

Think of it this way, $100 can be split in half (-50%) 6 times before you reach a number under 1. You can continue to split a number forever and it will never reach zero. Of course you are left only with decimals, but the point is that it takes A LOT of down days to wipe out the TQQQ.

Buy The Dip

Every investor has their own formula for buying and selling stocks. Some use technical charts, others do quarterly adjustments, and some of us simply go on gut feel. I am a fan of simple dollar cost averaging (DCA) during downturns. If you believe the stock market will go up over time then DCA is an easy way to buy the TQQQ.

Lowering your cost basis during bear cycles sets you up to capture large gains during the inevitable bull cycles. If you plan to hold the TQQQ over the long term then you should expect to experience both bull and bear markets. How you handle a bear market and negative sentiment plays a big role in finding success with a leveraged ETF.

Because the TQQQ will produce outsized losses on negative days, you have to diligently manage your cost basis. That is not to say you have to buy on every red day, but in my opinion you should add shares when the price falls 20% from your cost basis.

How many shares should you add? I've made the mistake of getting too excited when the price drops and buying too much, too early. I try to be more patience these days by adding small lots of 5-10% of my position. No one knows how long a bear cycle will continue so it is important to always have cash on hand…

Always Have Cash

You have to be able to add shares to your TQQQ when it is at low points in order to win over the long term. There is no other way around it. This means having cash available at all times in case the market goes on sale. The word “always” is key here. You can't spend all of your cash at the first sign of a downturn. What if the market continues to go down? Going “all in” on a single negative day breaks the rules if you don't have any cash left for tomorrow.

The longer you hold any stock, the more likely it becomes that you will experience a bear cycle or correction. On the bright side, the longer you hold the more likely it is you will experience a bull market. It takes discipline and faith in the stock market to buy low, but these events are THE buying opportunities! Missing out on them is very costly when you factor in the decay and fees associated with leveraged ETFs.

Remain Bullish (Long Term)

Being bullish on the QQQ is an essential mindset to have when owning TQQQ. You have to believe the worldwide leaders in technology and consumer products will continue growing. You should be confident of their ability to navigate recessions, pandemics and Federal Reserve policies. If this is not one of your core beliefs than the TQQQ is not for you.

Long term bulls like myself believe the market always goes up over time. They believe consumer spending always goes up over time. Bulls believe that technology is always evolving, creating new cycles of spending that will drive higher revenues and profits for the companies who own and produce it. This is the mindset you should have to invest in the TQQQ. Otherwise, the stress from all of the volatility will cause you to make mistakes.