Introduction to QQQJ Stock

The QQQJ is an ETF that tracks the Nasdaq Next Gen 100 Index, which includes the 101st to the 200th largest companies by market on the NASDAQ. It is a relatively new offering from Invesco with an inception date of October 13, 2020.

The index includes companies in various sectors, including technology, healthcare, industrials and consumer goods. Just over half of the fund is comprised of large cap stocks with market caps under $40 billion. The remaining balance features mid cap stocks with market caps under $10 billion.

1. QQQJ Holdings

The top holdings in the QQQJ for the first quarter of 2025 include eBay, Super Micro Computer, Alnylam Pharmaceuticals, Monolithic Power Systems, United Airlines, and Tractor Supply Company. The holdings are balanced across the board, with no single stock accounting for more than 2% of the fund's total value. 38 stocks in the index hold a % value between 1% and 1.99% This balance reduces the risk of a single stock disrupting the overall performance of the fund.

2. QQQJ Expense Ratio

The expense ratio for QQQJ is 0.15%, which is below the median of 0.45% for all ETFs and inline with the median of 0.16% for index ETFs. This expense fee equates to $150 per year for every $100,000 invested. It covers the ETF's operating expenses, including management fees, administrative expenses and other costs associated with the ETF.

4. QQQJ Dividend

The QQQJ has limited dividend history given its recent inception, but it paid a 0.77% dividend in 2024. While this meager dividend may be a disadvantage for some investors, it is important to note that QQQJ's focus is on providing exposure to companies with more growth potential.

3. QQQJ Forecast

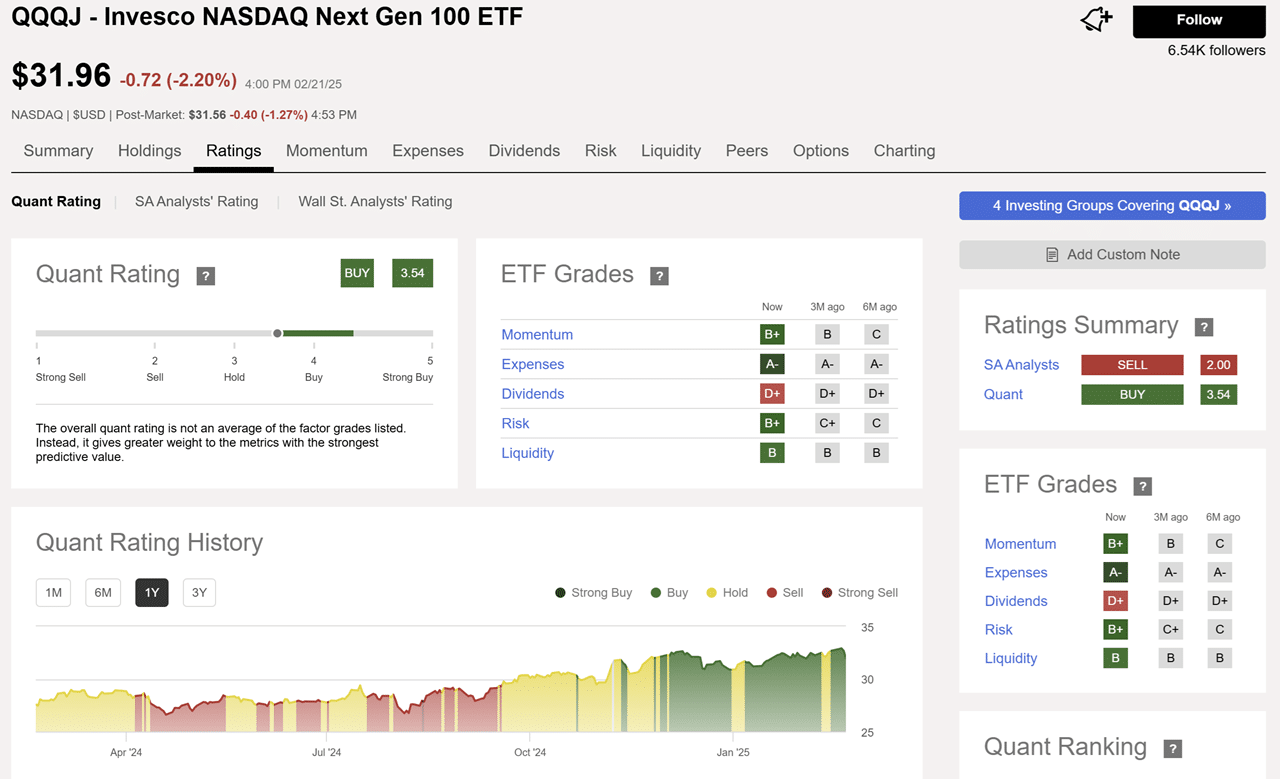

Like the broader market, the QQQJ had a solid run heading into the end of last year. So far in 2025, it has produced a +3.5% return, but the past 12 months have seen a total appreciation of over 16%. The Seeking Alpha Quant score currently gives the ETF a buy rating due to its positive signals for momentum, expenses, risk, and liquidity.

The challenge that all growth stocks face in 2025 is the “great unknown” when it comes to economic conditions. On the bright side, the fact that the QQQJ is well diversified should limit extreme downside risk. The more obvious downside is that many of the top holdings have valuation multiples based on revenue and earnings growth targets. If the economy remains flat, it is unlikely these multiples will expand, and that limits the upside for the QQQJ.

However, it is important to note that we have already seen significant fluctuations in the stock market here in the first weeks of 2025. It is not unimaginable to think that interest rates and inflation could fall. Both of these instances would likely boost the multiples for the underlying holdings of the QQQJ.

5. QQQ vs QQQJ

Even though the ticker symbol for QQQJ is similar to QQQ, it is important to note that these ETFs have entirely different holdings. The QQQ represents the Top 100 stocks in the NASDAQ while the QQQJ represents the stocks ranked 101-200 by market cap. The only similarity is that both funds exclusively feature NASDAQ stocks.

The QQQJ is also more balanced than the QQQ. The Top 10 holdings of the QQQ represent over 50% of the funds value. The QQQJ on the other hand has 40 stocks within its top 50%.

The QQQJ is comprised mostly of large cap and mid cap stocks, with the largest stock coming in under $40 billion in market cap. The QQQ features 8 mega cap stocks with a market cap of over $1 trillion. This includes 3 stocks (AAPL, MSFT, NVDA) that have a market cap over $3 trillion each.

Conclusion

The QQQJ does offer an interesting array of stocks, some of which will likely grow to be included in the flagship QQQ fund. It has a fancy prospectus mission, offering exposure to the Nasdaq Next Generation 100 index, but ultimately this is just a moniker for the next 100 stocks after the QQQ's Top 100.

The limited exposure of each individual holding gives investors a nice basket of growth stocks while also protecting against single stock exposure. Overall, I see the QQQJ as a suitable addition to a diversified portfolio, but it is not an ETF I would exceed 20% exposure with.

Mid cap ETFS like the Vanguard VO fund have mixed returns vs the S&P 500. Some may argue that mid caps are undervalued compared to large cap stocks here in 2025, but I personally don't see an extended run of outperformance for the QQQJ. For my money anyway, the benefits of the QQQ outweigh those of the QQQJ.