Stock market investing can be intimidating when you are first starting out, but the truth is there are many simple strategies that have outperformed the smartest analysts for years. QQQ investing is one of those simple strategies, in my opinion. In this blog post, I'll outline the 9 key benefits of adding the QQQ to your portfolio.

Introduction to QQQ

The QQQ ETF tracks the performance of the Nasdaq-100 index. The index is composed of the 100 largest non-financial stocks listed on the Nasdaq exchange. It's a market-cap weighted index, meaning that the larger the company, the higher its weight in the index. The largest company in the index, Apple Inc., currently has a weight of 8%.

The QQQ ETF is managed by Invesco, which offers a variety of publicly traded stock and bond funds. Invesco is an investment management company, similar to Vanguard and Blackrock in that they offer investment products for both retail investors and financial firms.

What are the benefits of investing in QQQ?

There are several benefits to investing in the QQQ ETF. Here are some of the key benefits:

- Access to America's top technology stocks: The Nasdaq-100 index is composed of the 100 largest non-financial stocks listed on the Nasdaq exchange. It includes some of the most well-known and successful technology companies, such as Apple, Microsoft, and Amazon.

- Low expense ratio: The expense ratio for the QQQ is 0.20%, which is lower than the average expense ratio for ETFs. The lower the expense ratio, the more money you keep in your pocket.

- Historical performance: The QQQ ETF has outperformed the S&P 500 index for the past 10 years. Over the last decade, the QQQ has returned an average of 11.9% per year, compared to the S&P 500's 9.7% return.

- Market cap weighted advantages: Since the Nasdaq-100 index is a market-cap weighted index, the larger companies have a larger weight in the index. This means that the performance of the index is driven by the performance of the top companies.

- High AUM and liquidity: The QQQ ETF is in the top tier of assets under management (AUM) with over $332 billion and it is a highly liquid fund. This makes it easy to buy and sell the ETF at any time.

- Growing dividend: The QQQ ETF pays a growing dividend, which is currently yielding $2.85 dividend.

- Rules-based indexing: The Nasdaq-100 index is a rules-based index, meaning that the stocks in the index are chosen based on predetermined criteria. This removes the need for active management and reduces the risk of human error.

- Less risk than single stock exposure: The QQQ ETF is composed of the 100 largest stocks listed on the Nasdaq exchange, which means that you are exposed to a wide range of companies. This reduces the risk associated with investing in a single stock.

- Buying the QQQ is easy. Because the QQQ is one of the most popular exchange-traded funds, it is available on nearly every brokerage and stock investing app. Most platforms offer QQQ trading for free, with no commission charges for buying or selling the stock.

America's top technology stocks

The Nasdaq-100 index is composed of the 100 largest non-financial stocks listed on the Nasdaq exchange, which includes some of the most well-known and successful technology companies. This means that the QQQ gives you exposure to companies such as Apple, Microsoft, Amazon, Alphabet (Google), Facebook, Tesla, and NVIDIA.

The index is designed to provide exposure to a wide range of companies across different sectors, such as technology, consumer discretionary, healthcare, and communication services. Buying just one share of QQQ gives you exposure to these sectors without having to buy individual stocks.

Low expense ratio

The expense ratio for the QQQ is 0.20%, which is lower than the average expense ratio for ETFs. The lower the expense ratio, the more money you keep in your pocket.

It is also worth noting that the QQQ ETF is a passive fund. This means that it is not actively managed. This reduces the costs associated with the fund, which is reflected in the low expense ratio. An actively managed fund like ARKK for example, has an expense fee of 0.75%.

Impressive historical performance

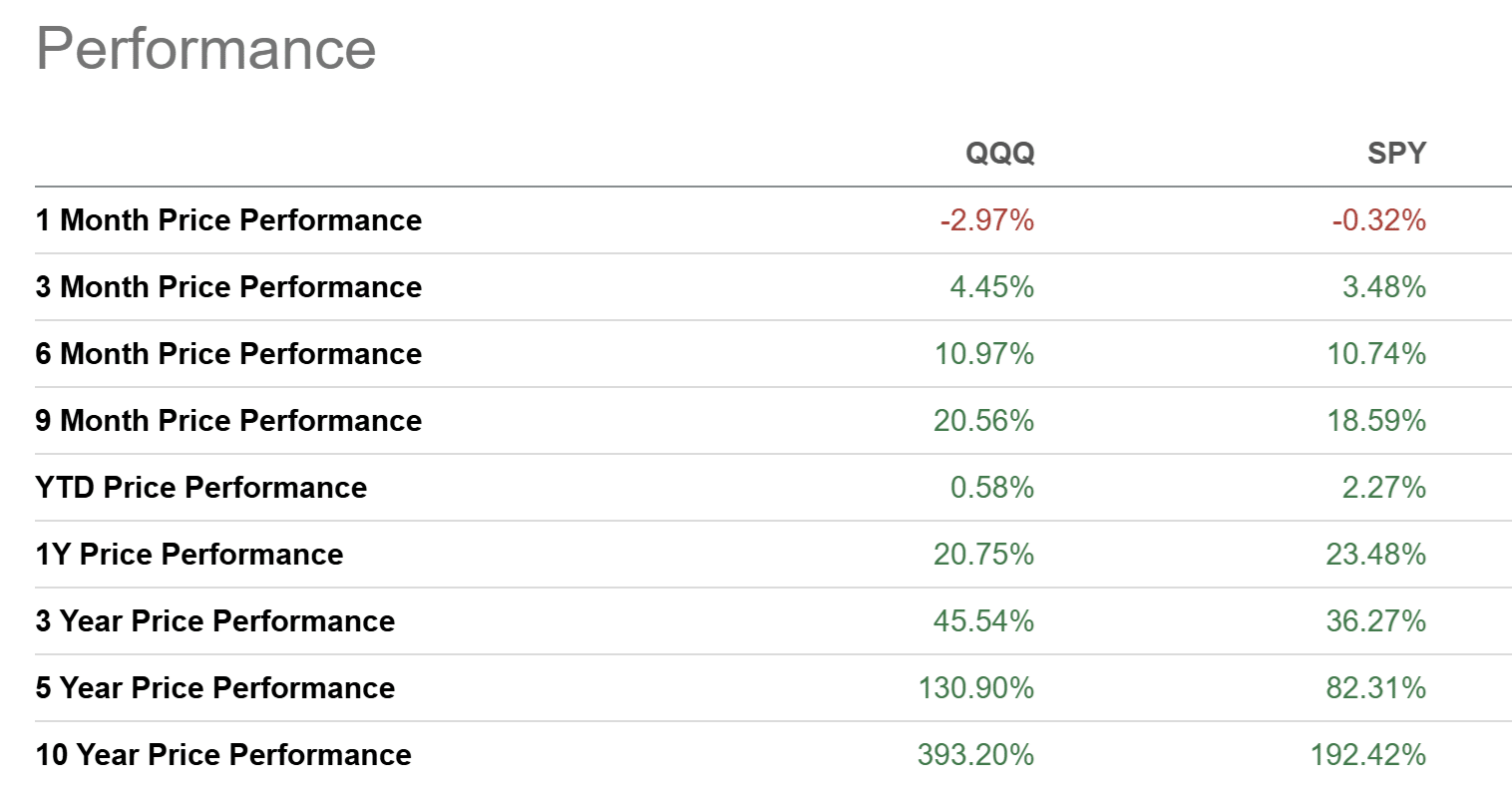

The QQQ ETF has outperformed the S&P 500 index over several notable time frames, although it did underperform it in 2022. Over the last decade, the QQQ ETF has returned an average of 17% per year with dividends reinvested, compared to the S&P 500's 12% average return with dividends reinvested.

Here is a table historical comparison between the QQQ and S&P 500 as of 2023…

Market cap weighted advantages

The Nasdaq-100 index is a market-cap weighted index, meaning the largest companies by market cap have the highest weight in the index. With this, the performance of the index is driven by the performance of the top companies. In the case of the QQQ, the Top 10 holdings account for 50% of the total fund.

NVIDIA Corp 8.93%

Apple Inc 8.37%

Microsoft Corp 8.22%

Amazon.com Inc 6.13%

Broadcom Inc 4.60%

Tesla Inc 3.70%

Meta Platforms Inc 3.44%

Alphabet Inc 5.5% (combined A and C shares)

Netflix Inc 2.56%

Many view this concentration in the largest market cap stocks as a positive attribute. Typically, large-cap stocks are less prone to big price swings. This can offer protection to the downside, and in the case of the QQQ, the largest companies have been some of the top outperformers over the past several years.

High AUM and liquidity

The QQQ ETF has a high amount of assets under management (AUM) of over $330 billion and an average daily share volume of over 30 million. This size and amount of trading volume make it very easy to buy and sell the ETF at any time.

A key benefit to QQQ over the QQQM (which tracks the same index at a lower expense fee of 0.15%) is the robust options market available to QQQ shareholders. If you are interested in selling covered calls or using the wheel strategy to boost your investment income, the QQQ is one of the best ETFs available.

Growing dividend

While not necessarily known as a dividend-paying ETF, the QQQ does payout a dividend yield of 0.54%. The dividend payments are distributed quarterly, which means you can expect 4 distributions per year.

Since 2015, the total dividend has increased every year except for 2021, when the COVID stock market downturn lowered the dividends of many companies. Overall, the QQQ has provided investors with a +10% dividend growth rate over the past 3 year, 5 year, and 10 year time periods.

Rules-based indexing

The Nasdaq-100 index is a rules-based index, meaning that the stocks in the index are chosen based on predetermined criteria. This removes the need for active management and reduces the risk of human error.

A rules-based approach also eliminates emotions from the stock selection process. It insures the index is diversified and that the portfolio is not overly concentrated in a single stock. New additions are made during the annual reconstitution process in December, and the fund rebalances quarterly.

Less risky than single stock exposure

Investing in individual stocks can be risky, especially if your portfolio is focused on only a small selection of stocks. The QQQ offers exposure to 100 different companies through a single investment. While no fund should encompass all of your investing dollars, an index fund like the QQQ can reduce the risk associated with investing in a single stock.

Buying the QQQ is easy

Because the QQQ is the most notable fund associated with the Nasdaq stock exchange, it can be purchased through almost every known brokerage in the United States. With many brokerages lowering commission fees over the past few years, most investors are able to trade the QQQ for free.

In a world where investment products can be difficult to understand, the QQQ provides several investing strategies in a single fund that won't nickel-and-dime you with commission and expense fees.

Conclusion

The best way to see if the QQQ fits your investing strategy is to simply review the list of holdings. If you are searching for an easy way to diversify your stock portfolio and gain exposure to America's top technology stocks, the Invesco QQQ is likely a fit. As always, past performance does not guarantee future success, but most bull market cycles are led by technology and innovation, which is where the QQQ makes a strong case as a good long-term investment.