There is plenty of discussion about the current concentration of S&P 500 and QQQ. With both indexes heavily concentrated in their top holdings, it's sparking concerns among investors about whether this level of concentration is healthy or dangerous. But are these concerns valid? Let’s break it down.

10 Stocks Equal 38% of S&P 500

You've probably seen some of the charts and statistics on social media showing how the top 10 stocks make up a record 38% of the S&P 500. For comparison, if you rewind to 1990, this figure was closer to 25%. Today's higher concentration pattern began during the infamous dot-com bubble around 2000, when Microsoft, Cisco, GE, and Intel saw rapid growth in market cap.

Today, Microsoft, Apple, Nvidia, Alphabet, and Meta are the top stocks in the index. While there has been some movement between positions, the core have remained in the Top 10 for several years now.

A Market Cap Weighted Index

The S&P 500 and QQQ are both market-cap weighted, meaning the stocks with the largest market capitalizations automatically receive the highest weightings. This structure is designed to reflect the real market value of companies, rather than subjective or arbitrary decisions about which stocks are most valuable.

When critics say the S&P 500 is top-heavy, they’re not necessarily wrong, but they are missing the goals outlined in the fund's prospectus. This system isn’t rigged; it's a natural outcome of how the stock market functions. Companies rise and fall based on their earnings, revenue, innovation, and overall market performance.

A Historical Perspective

Looking at historical data, Exxon was the top stock from 1989 through at least 2010, consistently outperforming its competitors. But as technological innovation accelerated, companies like Microsoft, Apple, and Alphabet gradually overtook Exxon.

By 2015, the tech giants had claimed their thrones, with Exxon dropping down the ranks. And the same principle continues today. If a company like Nvidia experiences explosive growth, as it did between 2020 and 2025, the market cap-weighted structure ensures it climbs to the top.

As companies grow, their market cap increases, giving them more weight in the index. If a company outperforms another company in terms of revenue and earnings, they will eventually surpass them in the weighting. The rebalancing and reconstitution process is a natural form of portfolio management.

There Are Other Options

If the concentration of the S&P 500 or QQQ keeps you up at night, there are alternatives. Dividend-focused funds are one way to diversify away from top-heavy index funds. For example, dividend ETFs tend to emphasize financials, healthcare, consumer defensive sectors, and energy, while technology typically only is underrepresented since many of the top tech companies focus on growth over dividend distribution.

One expample of this is Schwab U.S. Dividend Equity ETF (SCHD). The sector allocation breakdown for this fund currently stands at:

- Financials: 18%

- Healthcare: 16%

- Consumer Defensive: 14%

The information technology sector comes in at 7th on the list with a 9% concentration.

In comparison, QQQ, which tracks the Nasdaq-100 Index, is overwhelmingly weighted toward technology stocks. In fact, technology makes up nearly 60% of QQQ’s allocation, with the top holdings being Apple, Microsoft, Nvidia, Broadcom, and Meta.

Concentration Performance

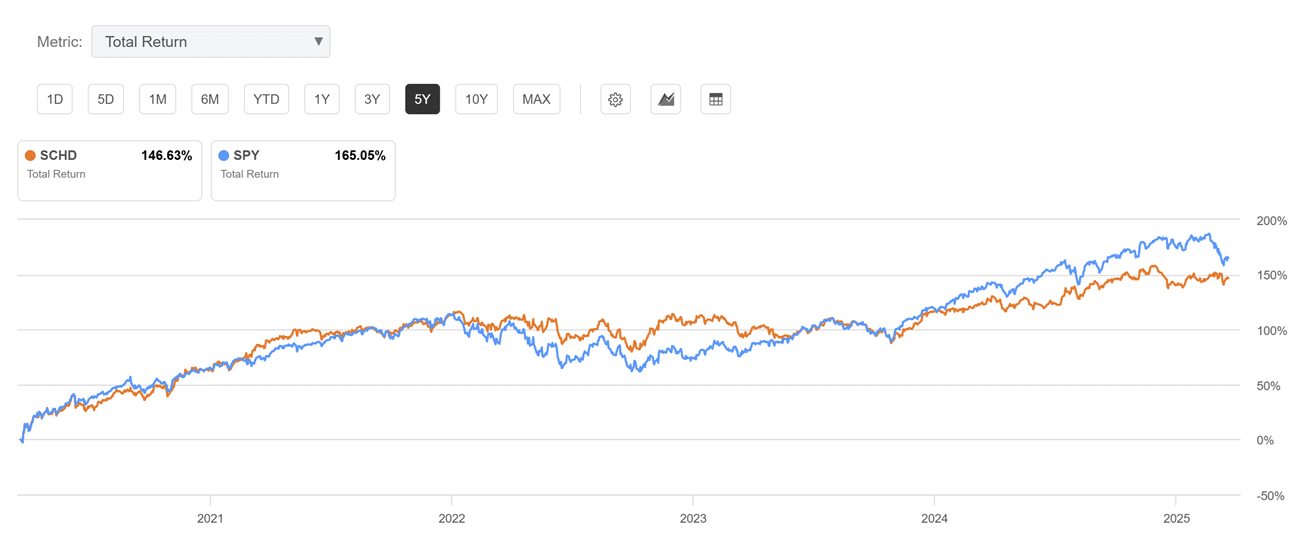

What about performance? Over a five-year period, the S&P 500's total return was about +168%, compared to +140% for the SCD ETF. This shows that while top-heavy ETFs can provide higher short-term gains, dividend funds and other diversified approaches can offer similar returns over the long term, with less concentration risk.

Bottom line: investors have plenty of options.

Should You Be Worried About Your S&P 500 ETF?

The fear of over-concentration is largely overblown, in my opinion. The structure of market cap weighted indexes is designed to reflect the true value of companies as determined by the market itself. If you are concerned, though, there are plenty of other investment vehicles you can explore.

And remember, the top stocks today may not be the top stocks tomorrow. The indexes will rebalance and reconstitute every quarter and year accordingly. This guarantees you will capture some exposure when the next NVDA comes out of nowhere.